US Government Shutdown Threatens Crucial Economic Data Releases

Send us your feedback to audioarticles@vaarta.com

The Bureau of Labour Statistics (BLS) will stop releasing inflation and unemployment data during a US government shutdown. Investors and the Federal Reserve would struggle to appraise the US economy without this government data.

Current economic conditions are unpredictable. A "soft landing" might lower inflation to the Fed's 2% target without raising unemployment. The Fed's 11 interest rate hikes could cause a recession.

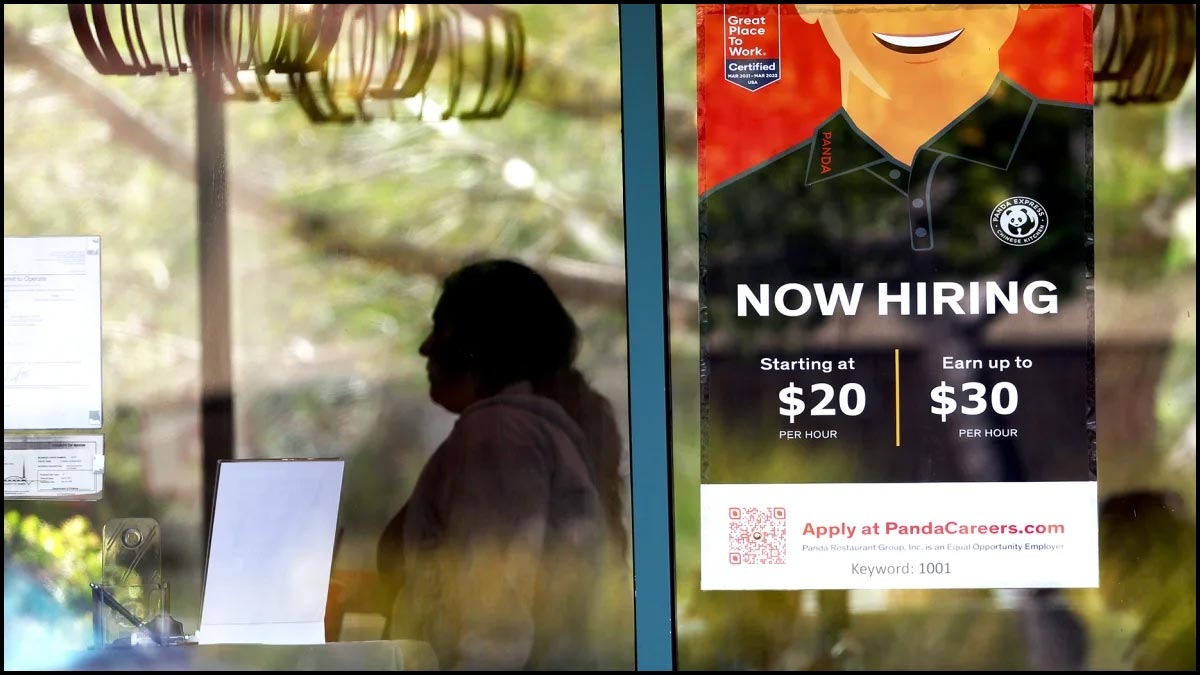

The BLS releases key economic data like the Consumer Price Index (CPI) for inflation and the Employment Situation Summary for unemployment and job growth. These reports are crucial to investor decision-making.

As House Republicans struggle to pass a defence budget package, they settle for temporary financing, threatening a government shutdown. Some Republicans threaten to fire House Speaker Kevin McCarthy if their demands aren't satisfied. This political impasse will threaten government finances.

A federal government shutdown will cease data collecting, processing, and dissemination, according to the BLS, which might delay data. In today's economy, when the Fed's monetary policy decisions require precision, such government data is critical for decision-makers.

The Fed is uncertain about how rate hikes have harmed economic growth. The Fed extensively relies on data for policy decisions, therefore a lack of timely data could lead to policy mistakes and additional costs and risks for investors and families.

Follow us on Google News and stay updated with the latest!

-

Bala Vignesh

Contact at support@indiaglitz.com

Follow

Follow

-7c2.jpg)

Comments