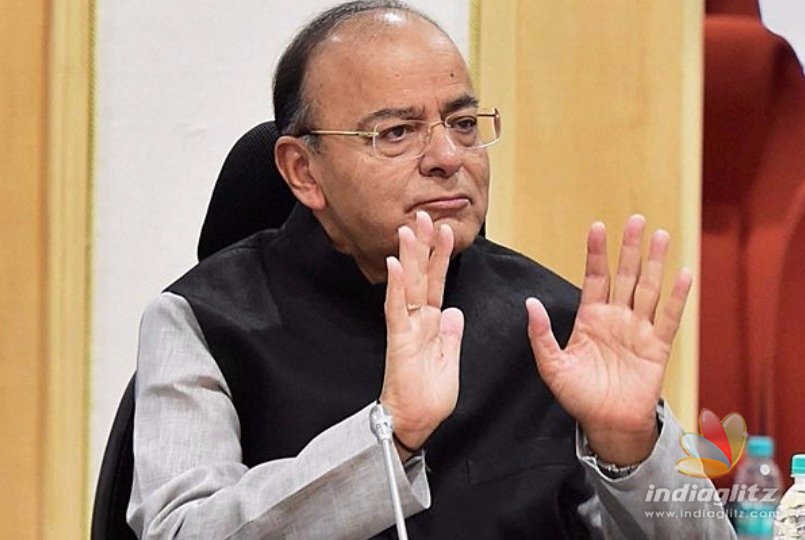

No need to give PAN/Aadhaar card details to purchase jewels: GST Council

Send us your feedback to audioarticles@vaarta.com

The monthly meeting of the GST Council, which was headed by Union Finance Minister Arun Jaitley, has decided not to insist on furnishing PAN Card or Aadhaar Card details from customers who purchase gold and other jewellery (worth Rs.50,000 or above) from jewellery stores across the country.

The decision was taken at yesterday’s meeting and a formal Govt. order ratifying the decision is likely to be released soon. The Council’s earlier decision to insist on furnishing PAN/Aadhaar card for purchase of jewellery worth Rs.50000 and above; however, the decision adversely affected sale of jewellery in many States and jewellery store-owners had expressed their reservations about this particular aspect. Following are the salient features taken at yesterday’s meeting of the GST Council:

• E-Valet system to be introduced from exporters from April, 2018 onwards;

• Unbranded ayurvedic medicines would have reduced GST of 5%;

• Handloom thread would now have reduced GST of 12%;

• Stationery items & diesel engine/pump spares – GST reduced from 28% to 18%;

• E-way bill across the country for transportation of goods from January, 2018;

• Input tax credit paid exporters to be refunded w.e.f. 10th October;

• Business with annual turn-over less than Rs.1.5 crores can submit quarterly GST returns and not monthly returns;

• Cabinet to take a decision on demand for reducing GST for A/C restaurants;

• Unbranded snacks/namkeen to have reduced GST of 5% from 12%; and

• In all, GST on 27 products/items has been reduced.

Follow us on Google News and stay updated with the latest!

-

Contact at support@indiaglitz.com

Follow

Follow

-a3e.jpg)

-3c4.jpg)

-e5c.jpg)

-e66.jpg)

-71b.jpg)

-5d5.jpg)

-adc.jpg)

-798.jpg)

-7c2.jpg)

Comments