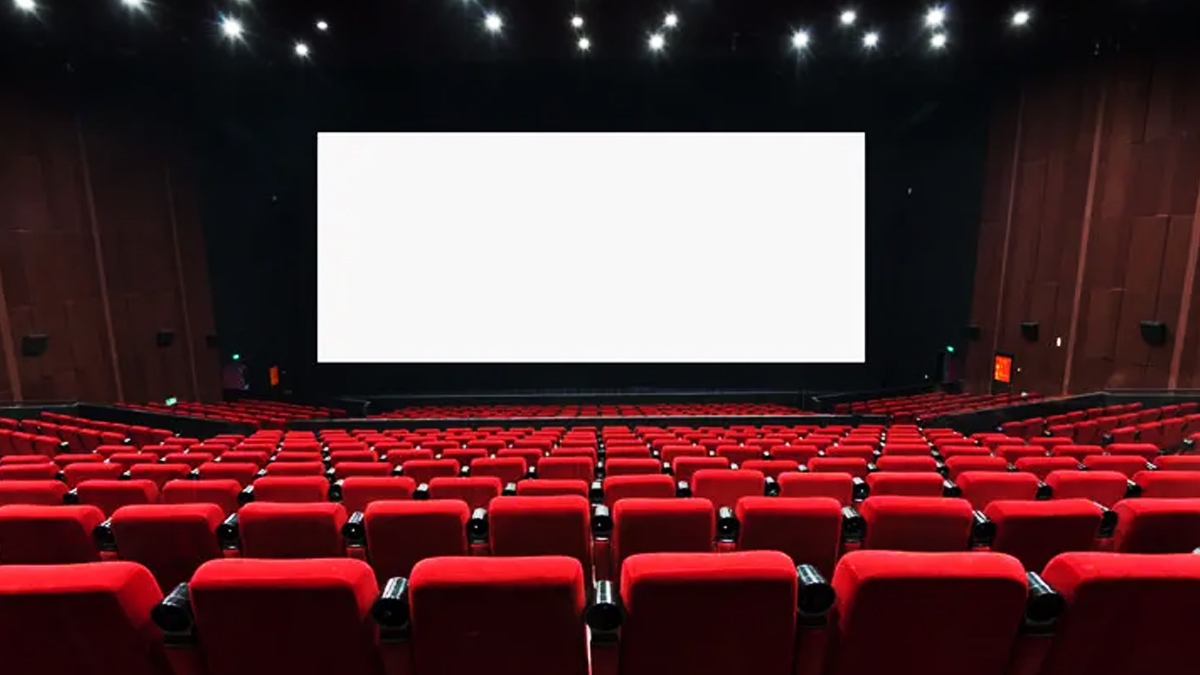

Breaking: GST rate in Cinema Halls has been reduced; Deets inside

Send us your feedback to audioarticles@vaarta.com

The multiplex industry has welcomed the GST Council's notification that food and drinks (F&B) sold at movies will be covered under the definition of 'restaurant service' and will be subject to a 5% GST, an issue that has been the source of disputes and litigation in recent months.

The lastest reports indicate that the news for movie watchers GST rate on food served in cinema halls reduce to 5% from 18%. Reportedly, PVR, INOX shares gain after GST cut on food and beverages.

Earlier, the multiplex business petitioned the government to provide greater clarification on the subject after tax officials in various state jurisdictions directed cinema owners to pay GST at the rate of 18% for F&B sold inside theatres.

"The entire cinema industry welcomes the clarification issued by the GST Council today (Tuesday) that food and beverages sold at the cinemas will get covered under the definition of 'restaurant service' and would be liable to GST at 5% (without availing of input tax credit)," PVR Inox CFO Nitin Sood said.

The above clarification will help resolve the industry-wide issue for the sector, which includes more than 9,000 cinemas across the country, by avoiding disputes and litigation from a GST standpoint, giving tax certainty, and restoring the theatrical business post-pandemic," he added.

This is a very welcome and pragmatic move by the GST Council, as the counters, food stalls, etc. within the multiplexes will be treated at par with all restaurants, thereby removing any sort of discrimination and arbitrariness among the two classes," stated Rastogi, who is arguing multiple writs on such arbitrary provisions before different courts. The statement, the GST Council stated that the supply of food and beverages in cinema halls is taxable as restaurant service as long as they are supplied by way of or as part of a service and supplied independently of the cinema exhibition service.

However, it added that if the sale of cinema tickets and the supply of F&B are clubbed together and such a bundled supply satisfies the test of composite supply, the entire supply will attract GST at the rate applicable to the service of exhibition of cinema, the principal supply.

Follow us on Google News and stay updated with the latest!

-

Devan Karthik

Contact at support@indiaglitz.com

Follow

Follow

-7c2.jpg)

Comments